ROLLINGFUNDS - R-cREDIT

Transforming how small businesses access loans through RollingFunds

Introduction

A french fintech that provides bespoke financing for SMEs

RollingFunds is a fintech that partners with large businesses and marketplaces to offer bespoke financing services to small and medium-sized enterprises (SMEs) through its B2B2B business model.

In 2019, traditional bank loan processes for SMEs were slow, with lengthy paperwork that often resulted in declined applications. R-Credit was envisioned as the solution by providing SMEs with a streamlined access to working capital.

The Challenge

Giving SMEs a loan

The company needed a simple, intuitive way for small business owners to apply for loans without the friction of traditional processes.

The challenge was to design an intuitive, compliant platform that minimized user effort, supported mobile access, all while ensuring transparency and accessibility.

Role & Team

UX on paper, Full-stack in reality

As the company’s first Product and Web Designer, I worked directly with the founders to define the product vision and ensure that design decisions were technically feasible. Together with the project manager, we maintained clear timelines as the project moved toward launch.

Beyond product design, I helped craft the RollingFunds brand and sub-brands. I designed and trademarked logos, created marketing and sales materials. I also participated in the front-end integration myself, which ensured pixel-perfect implementation and a constant collaboration with the engineering team.

As the company grew, I mentored a junior designer as well as design intern, guiding them through our transition from Adobe XD to Figma to improve collaboration and workflow efficiency.

MY APPROACH

A process adapted to startup realities

Working in a small, fast paced team meant shaping a process that was realistic and adaptable. I focused on the essentials, moved quickly from research to design, and integrated directly with engineering. Continuous monitoring replaced a formal testing phase, allowing us to iterate rapidly after launch.

Overcoming Obstacles

Adapting the process to keep the product moving forward

The main challenge was speed. Building a design-driven fintech platform in just three months meant balancing engineering constraints and a rapidly scaling team.

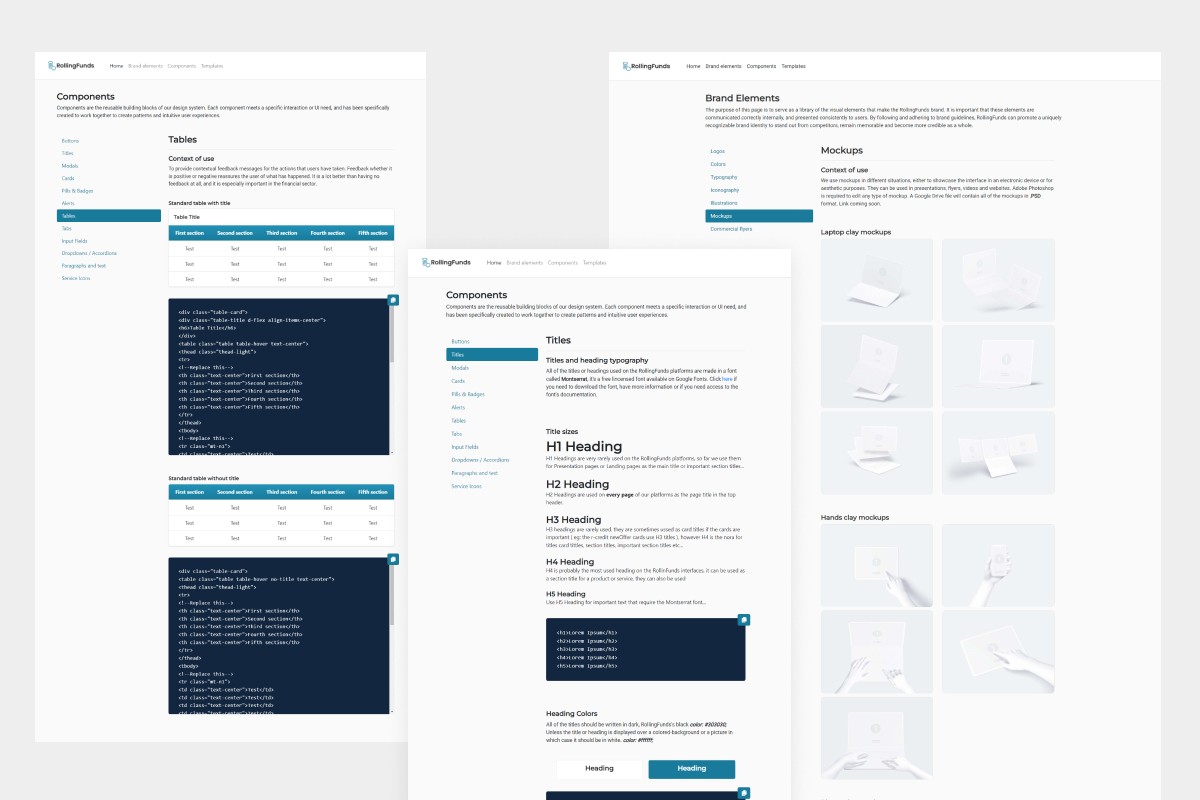

RollingFunds had no design system when we started, which risked UI inconsistency as the development team tripled in size. I solved this by creating a coded system that acted as a visual and structural framework, allowing the engineers to move fast without losing coherence.

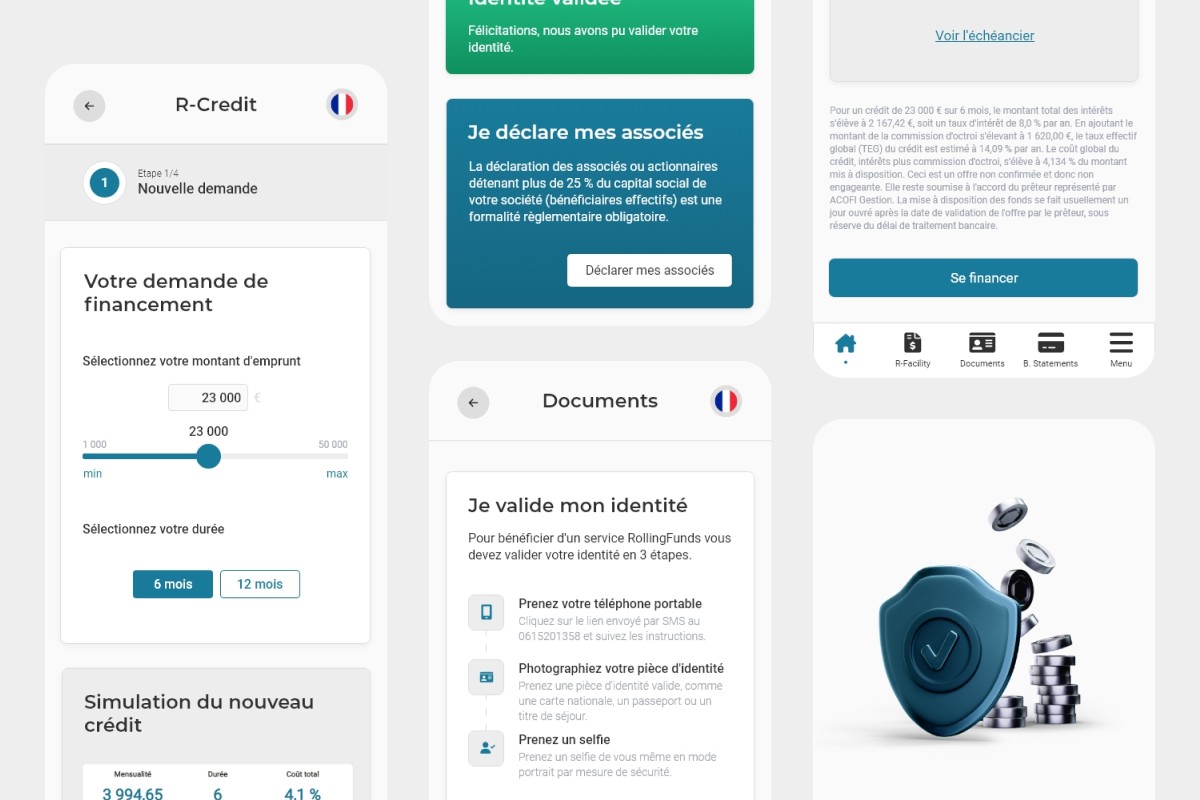

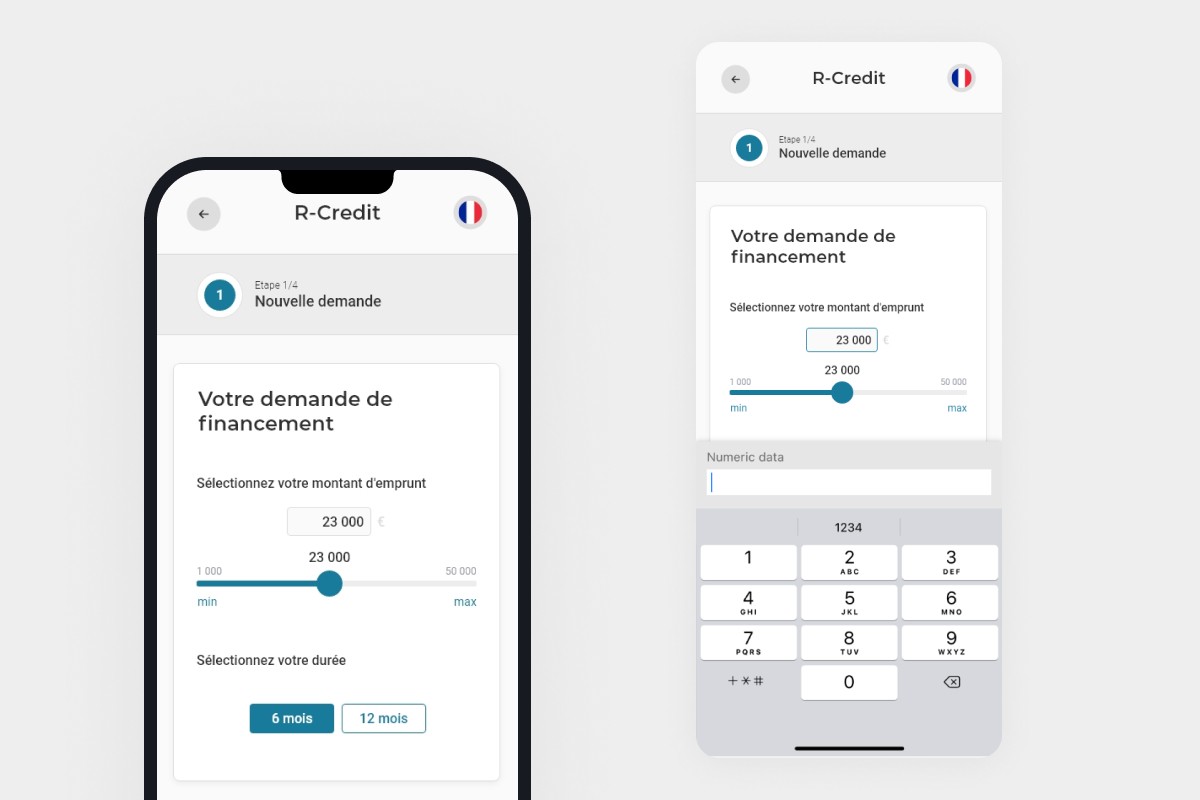

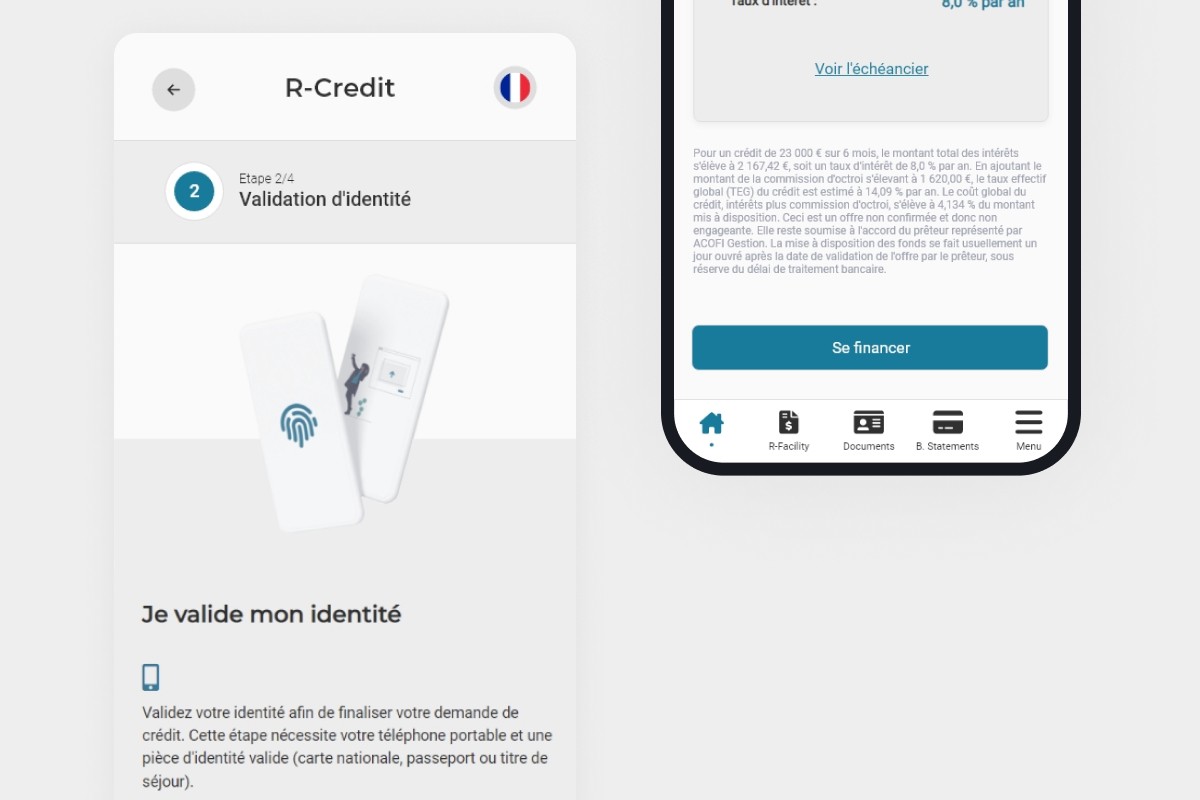

Another key issue was mobile optimization. With around 50% of users accessing the platform on phones, we needed a mobile-first experience. I worked closely with engineers to ensure that all screens were responsive and to integrate a identity verification (KYC) service that worked on smartphones, making the process frictionless on both desktop and mobile.

Solution

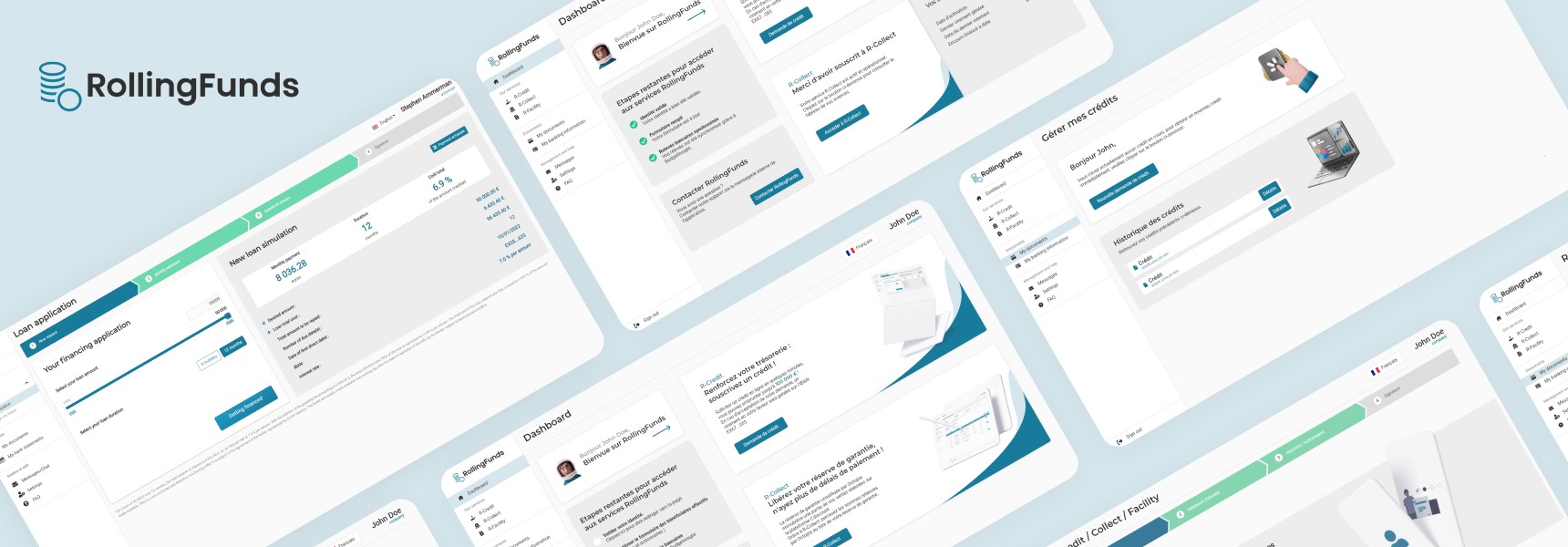

Get your loan approved in a few minutes

The result was a five-step loan application flow designed for speed, clarity, and trust. Users can select loan parameters using a slider or direct input, with live repayment simulations updating instantly. They verified their identities through a secure, mobile-first KYC process, declared beneficial ownership to meet compliance requirements, reviewed and signed contracts digitally, and received instant confirmation once complete.

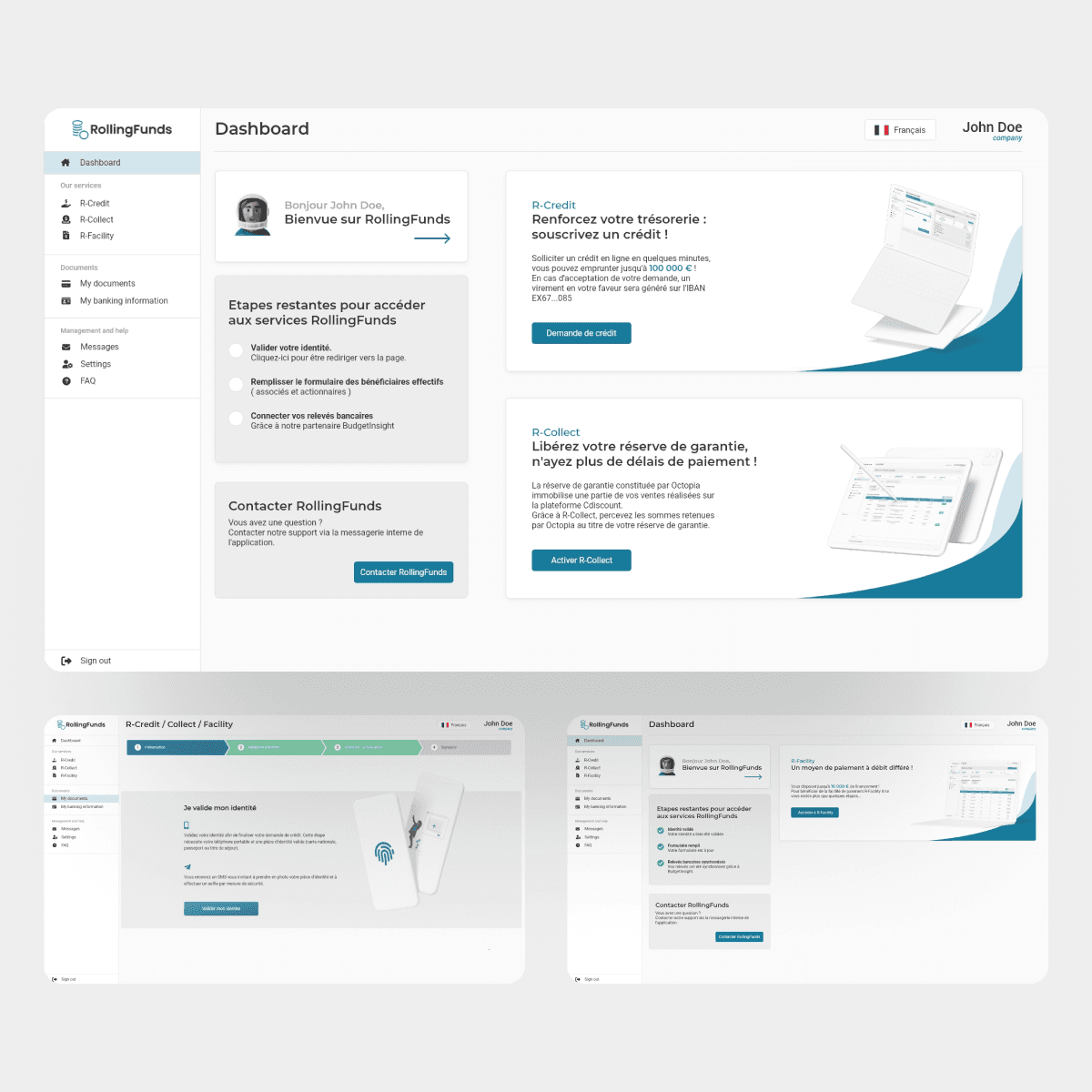

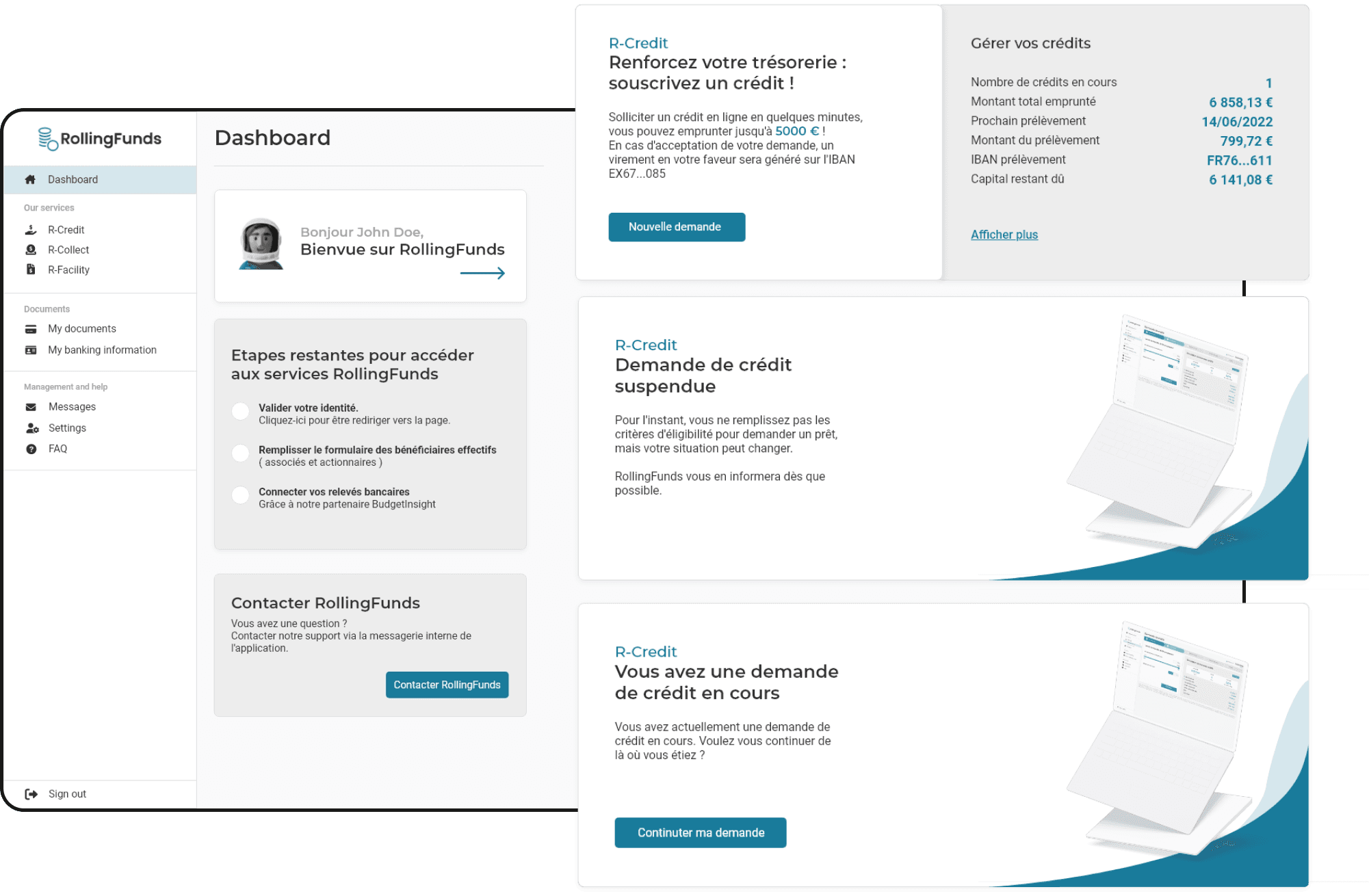

The dashboard allowed users to revisit ongoing or past applications, restructure loans, download documents, and monitor repayment progress. Contextual cards displayed eligibility and borrowing capacity, making the platform not only functional but informative.

All of this was wrapped in a responsive design that maintained a clean, consistent experience across devices, supported by the design system I built for long-term scalability.

Results

R-Credit is up and running!

The final product was a user-friendly loan application service that offered a streamlined approach to securing loans for businesses. R-Credit received positive feedback from users, who appreciated the speed and simplicity of the loan application process.

The design solution met the objective of creating an easy-to-use service that provided a high level of security and compliance. RollingFunds lent millions of euros to European SMEs using R-Credit.

Impact

Successful product generating revenue

The R-Credit loan application product was a clear success story for RollingFunds. It enabled the company to generate revenue in a short timeframe, which directly contributed to a successful fundraising round of 5 million euros afterwards. This success was largely thanks to how R-Credit addressed real SME financing needs while creating a fast and simple experience for users.

The partnerships formed as a result of the product's effectiveness helped expand our client list beyond France into three other European countries; including Belgium, Germany and Spain.